On Systemic Investing

Systemic investing is a promising complement to impact investing - moving from single point impact funding to a coherent portfolio logic to fund connected systems change initiatives and ecosystems.

Fifteen+ years ago I was exploring and grappling with different notions of how change happens and trying to understand how we are able to exert influence on the shape, direction and pace of that change.

As I went deeper into the different contexts, sectors, skills, capabilities and processes, not only did my understanding of the scale of the challenge grow, but so did my recognition of the patterns which perpetuated these interconnected systems and often prevented them from changing.

I delved into focusing on local food systems, youth mental health & wellbeing, biodiversity, and climate change. I increasingly realised that not only did I need to be working on change "in" those domains, but we also needed to be working "on" the patterns and forces which perpetuated things too - essentially, I found systems change work.

I soon realised that the boundaries that define what you can work on are decided in the design and planning phases of a systems change initiative. But even more so, the funding of that initiative itself.

If the funding is restrictive, there will always be conditions on the activity and edges to what an initiative is capable of achieving. Sometimes this can be healthy (avoiding scope creep), yet more often than not it can be deeply problematic.

Systemic challenges require systemic answers, but currently the dominant funding practices are ill-suited to support them. Systems change leaders often struggle because current funding practices are often built to support short-term projects with clear, measurable results rather than collaborative, evolving approaches to create lasting change.

55 percent of the systems change leaders we surveyed disagreed when asked whether their funders provide sufficient support for systems change work.

- Embracing complexity: Toward a shared understanding of funding systems change (2020) Ashoka

How do we fund initiatives in service of systems change?

Over the years I've tuned into different models for more collaborative funding, funding based on greater degrees of trust, unrestricted funding to allow an initiative to be more flexible, participatory granting to change power dynamics, impact-focused funding - they all felt like they were getting at aspects of what was needed but didn't encompass everything.

I always felt like invesment finance and capital felt like another world however - risk, hedging, portfolios, diversification, endowments - I didn't really understand their relevance to what I was up to in the 'systems change world'.

But slowly I've been piecing together the jigsaw puzzle of what I thought was needed and I increasingly started to see some overlaps in these worlds, terminologies, as well as the need for an array of different types of finance for different types of outcomes:

- Funding must be developed through systems thinking / complexity awareness to match the interconnected nature of challenges, opportunities & co-benefits

- Finance needs foresight/futures orientation to engage with risk, diversification and the different time horizons of outcomes

- Multiple forms of finance are needed, deployed for particular aspects of systems change work - consider what types of finance support what phases

- The bringing together of these coalitions or consortia is best empowered by deeply collaborative relationships which needs explicit time and space to grow

- Finance needs to be focused on a common direction (challenge or vision) through the lens of an agreed theory of change (which may have specific elements that specific investors are interested in

- Finance needs to connect and amplify across a portfolio of initiatives or projects (and invest in a backbone function to do this) to act as a multiplier of value and impact

- The funding logic(s) must then be informed over time by the grounded reality of what is happening as an initiative explores, tests and adapts

- There will likely be the opportunity and the need to crowd in more partners over time, so design for this from the beginning

Over the last 2 years this question of finance has been bubbling up for me again and again as I better understand the research, education, partnering and infrastrastructure aspects which my University role connects with. At times the siloed nature of funding feels commonplace, and at other times I can see bold and ambitious funding approaches which unlock all sorts of value creation.

I've watched closely as some key initiatives have emerged around the world which are formalising these ideas of funding for systems change work into a new logic - Systemic Investing.

What is systemic investing?

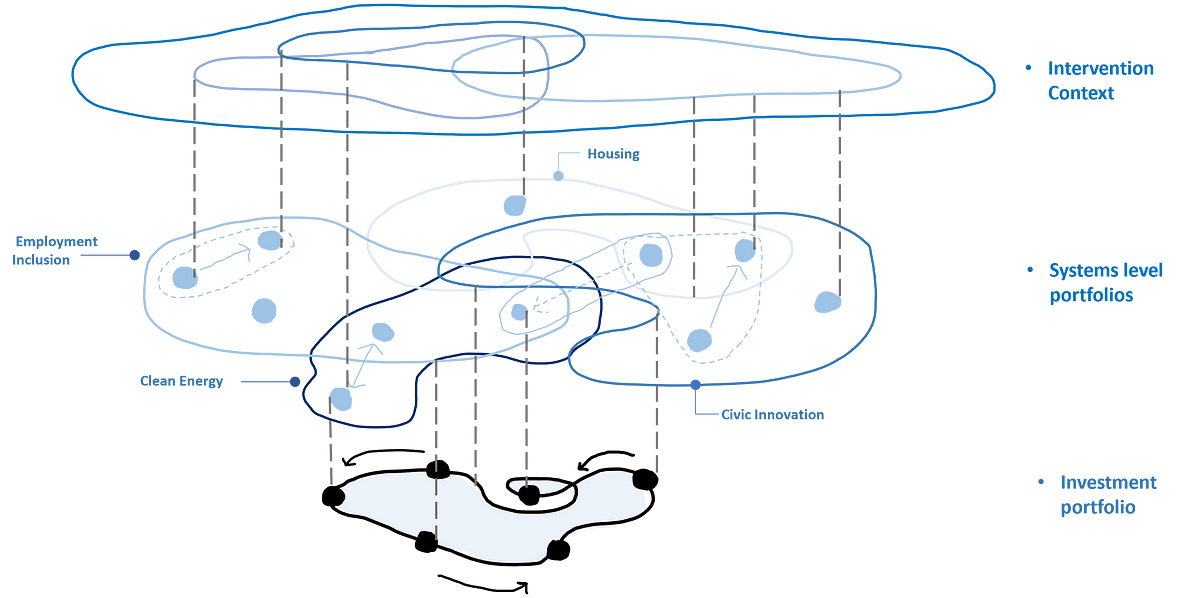

Systemic Investing is the strategic deployment of diverse forms of capital, guided by a systemic theory of change and nested within a comprehensive systems intervention approach, for the purpose of funding the transformation of human and natural systems.

- TransCap Initiative's definition

This feels like a succinct version of the points I was making above.

What's the difference between impact investing and systemic investing though?

Traditional impact investing “assumes that transformative change can emerge from single technologies, projects, or social enterprises”; in contrast, “systemic investing assumes that systems change is most likely the effect of multiple shifts happening within a system at the same time and with a degree of strategic coherence”.

- Dominic Hofstetter, TransCap Initiative: What is systemic investing?

The Leading Lights

These are the main groups I've been watching:

TransCap Initiative

With their origins in Deep Demonstration work with EIT Climate-KIC, TransCap have really been a significant pioneer in the Systemic Investing space. Their original whitepaper (PDF), and recent Hallmarks article have both been fundamental for me to understand and tune in to the possibility this poses for how we shape initiatives.

Changing systems often means that a multitude of different kinds of capital — provided by different capital holders and financial intermediaries — need to be coordinated strategically in order to fund vast swaths of interventions that, in combination, have the potential to trigger transformative effects.

- TransCap Initiative

Regen Melbourne

.png?format=1500w)

Our local Naarm (Melbourne) initiative which plays in the realm of Wildly Ambitious Projects, Regen Melbourne released an excellent paper based around systemic investing (MIST) which has some excellent theory and application of the ideas around the Swimmable Birrarung initiative.

Ultimately, our current financial paradigm is blind to the quality and magnitude of risks we face, and is equally blind to the transformational opportunity that lies in structuring system-level value. Money is not flowing in service to life.

- Regen Melbourne

Landscape Finance Lab

Whilst the Landscape Finance Lab doesn't explicitly talk about systemic investing (they talk more about Impact Investing which is slightly different - see TransCap for more), it follows much of the same logic about mobilising different forms of capital in service of regenerative intiatives. Whilst their primary focus is nature-based solutions, I think some of the spinouts such as Matanataki, which is in service of the Fijian Reef, are representative of how Systemic Investing can take shape over time.

"Landscapes group and aggregate activities to achieve larger impact and synergies. Blending public, private and philanthropic sources of finance allows for investment across different types of activities and at different stages of development. Public and philanthropic funds, for instance, can support more accurate measurement systems while loans and equity are more relevant for business activities."

- Landscape Finance Lab

Pando Fund

The Pando Fund is in development and their focus is on 'finance for systems health' with logic which is very much aligned with systemic investment. Their focus is on ecosystems of change, portfolio approaches, and recognising both the potential and need for relational practice within this ecosystem. They also highlight the importance of shifting from 'single point' funding approaches due to the scale and complexity of the challenges which continue to grow. Ther lay out more of this in their first article on finance for system health here too.

Imagine that this funding allowed leaders to work in infinitely more connected, relational, iterative, and mutually reinforcing ways. Equally important, this funding mechanism enhanced their ability to gain an ever-improving understanding of the complex system within which they work through collective sensemaking, experimentation, learning, and adaptation. And to do all of this over the decades we know much deep transformational work requires. Imagine financing that allowed us to operate less like individual trees and more like a vast, interconnected, interdependent ecosystem.

- Robert Ricigliano and Anna Muoio

Good Shifts (prev Griffith Centre for Systems Innovation)

A provocation from Good Shifts which was then prototyped with Regen Melbourne in the Swimmable Birrarung initiative.

Good Shifts eloquently lays out the structure, principles and pathways for how systems capital might work to enable portfolio approaches to systems change. Additionally it lays out examples and illustrations of how this may look in practice.

It follows that systems challenges require systemic responses, and this should include how they are resourced.

This is the basic case for systems capital — if we’re serious about systems change, our investment approaches need to match the intention and reality of that pursuit.

- Good Shifts

Exploring systemic investing?

So what does it all mean? Are these just nice ideas? Utopian concepts? Well, I don't think so, and I'm keen to explore them because without them we continue to perpetuate single point funding and project-based change work which drastically reduces the potential of the work in the face of rising scale of challenges.

We need to slow down to speed up, so getting this piece right feels like an important place to focus on in 2025 for me.

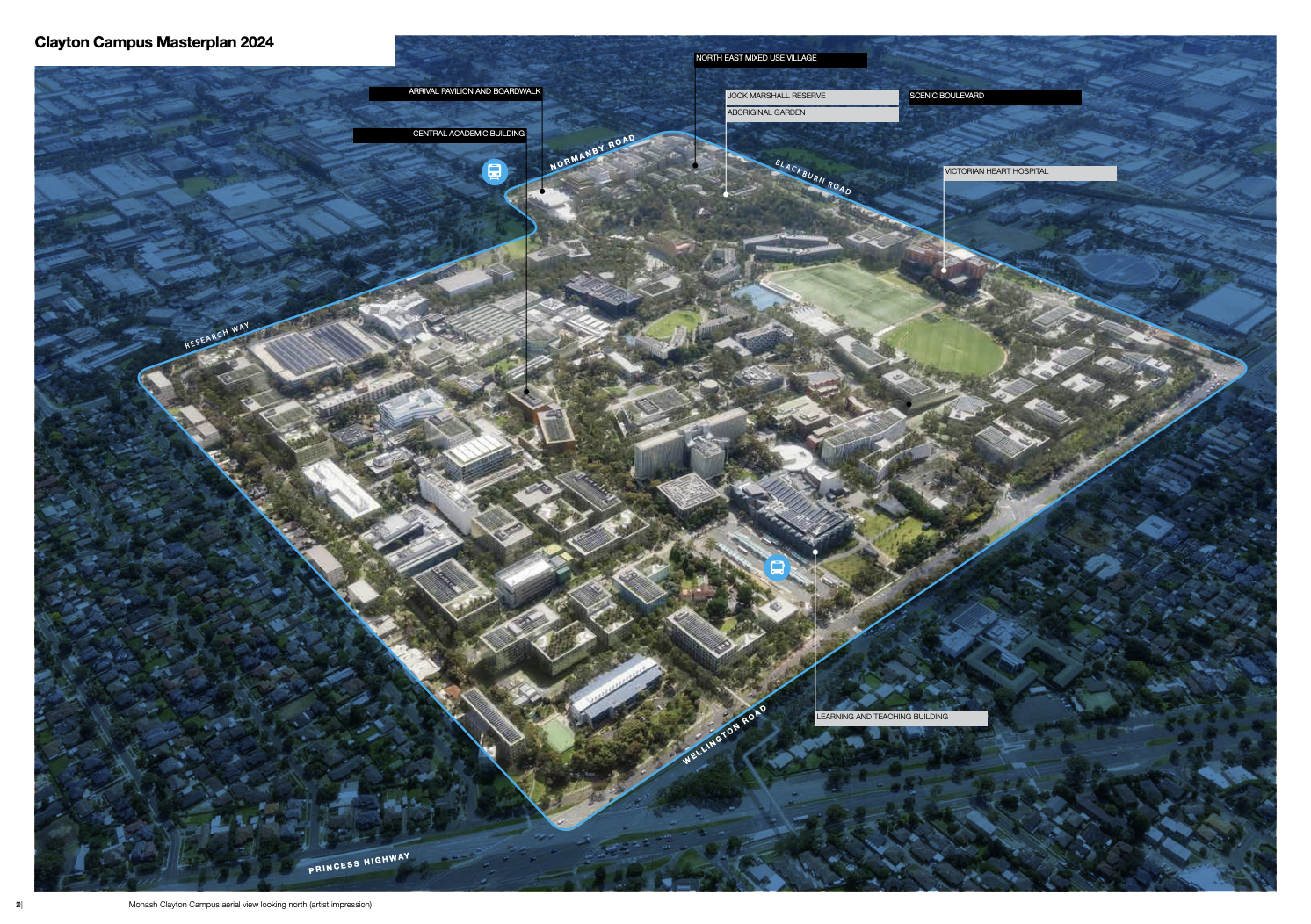

Example 1: Maximising the value of infrastructure investment

The area around Monash University's Clayton campus is an ideal location for developing and testing this logic. It's already a vibrant Tech Precinct, has a diverse community of residents, retailers, SME's and other organisations, and is due to undergo a signifciant urban transformation with the arrival of the Surburban Rail Loop to the north and south with the Monash and Clayton station precincts.

I've recently been talking about what it could look like to explore this area as a "Challenge Precinct" which might be focused on accelerating sustainable student housing, energy generation and storage and active mobility, recognising this is a leverage point for significant co-benefits and spillovers for health, connectivity, startup activity, research, education and more.

This feels like an ideal opportunity to explore systemic investing as both an organising logic and a process for partnership work around the 'ecotone work' of civic and private urban transitions. It might include how we build physical infrastructure, develop research & education initiatives on mobility or housing, do citizen science, build innovation capacity and more.

Visual: Targeted Systems Change with Enabling Systemic Finance layer?? CO BENEFIT SLIDE?

There's potential for a broad stack of value:

- Public and civic value such as reduced carbon emissions, lowered air pollution and increased civic common space

- Community and civil society opportunities such as improved safety, better town design and connectivity, shaping community-led initiatives such as urban greening or youth programs

- Commercial opportunties such as development of real estate, retail or other net zero service offerings (such as software, or final mile logistics solutions)

- Academic opportunities such as sustainability transition research, engineering case studies, and business microcredentials

To do this we know we know we will likely need to build consortia or coalitions, which makes me think of Bill Bannear's useful framing of their development phases here, but we also know we need work to build systems-level understanding, identify leverage points, build an investment logic and build the relational capacity of a group to steer this over time.

The opportunity? Actively steward directionality, intentions, outcomes and co-benefits from transitions enabled by government investment (or otherwise) such as SRL.

Example 2: Building community resilience

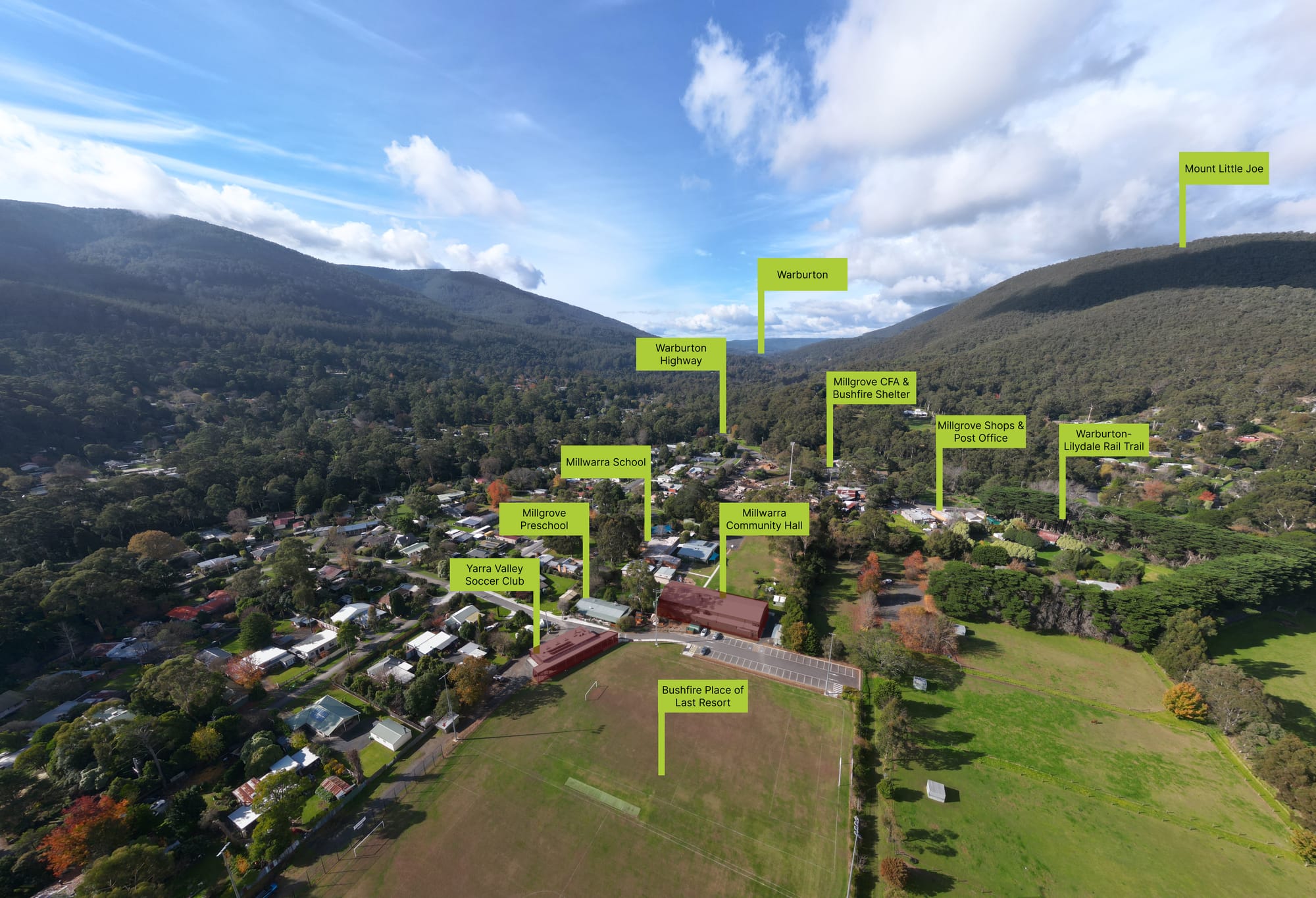

Let's look at a second example of an initiative bubbling away out in the Yarra Ranges in the village I call home: Millgrove.

Resilient Millgrove is a plan set out by the community here, with the support of Minderoo and ResilientCo, to proactively build social, infrastructural and environmental resilience to the many challenges the region faces.

One component we've been discussing is a place to gather in the event of a major multi day disruption (or disaster) such as a bushfire or major storm event. A place to come together, charge phones, cook food, have a shower, and connect with the outside world. This is what we would classically call an 'emergency hub' (PDF), but extending this idea to be more proactive about community programming, as well as developing resilient infrastructure (such as mesh networked communications) extends this idea to start to build capacity and connectiveness of the community - a Resilience Hub (more about those here and here).

Maybe the Hub could even include building economic resilience - such as developing community owned enterprises, a community foundation or the likes, to build resilience into the skills and livelihoods of the community as well.

I consider this a good a place as any to develop a world class community resilience initiative, building on the amazing work of the likes of MRAG, supported by the likes of the Yarra Ranges Council and Upper Yarra Community Enterprise over the years. Underpinned the next phase of development with a systemic investing approach may allow us to explore enabling partnerships, unlock vital capital, and

What does this stack of value and opportunities look like?

- Public and civic value such as increased resilience to disasters and disruptions, reduced volume of dependency on emergency services (such as CFA or SES), and potential to actively support community members who need extra support.

- Commercial value to the likes of energy system operators (like AusNet) for reduced outage risk and liability, improved local conditions for insurance providers which insure key buildings or infrastructure.

- Community opportunities to build new skills, connect with neighbours and community members, develop local livelihoods, reduce polarisation, tackle loneliness and more.

- Philanthropic opportunities to invest in place-based community resilience, climate adaptation and health with an equity lens. Develop replicable models and tools which can be adapted for other communities to grow their own resilience capacity and capability.

- Research and education opportunities to support applied programs looking at community resilience, participatory granting, emergency preparedness, decentralised energy, resilient buildings, community owned business models, place-based capital and more.

Enabling Factors

It's hard to realise these kinds of visions without putting several pieces in place:

- Funding a "platform" which has a core team to coordinate, align, connect and incubate different aspects of the overall vision. Something like a living lab, collective innovation platform, or some other form of ecotone organising will be needed.

- Vehicle(s) to hold and disperse capital - such as a named fund, community foundation, regional investment fund, localised impact fund, community owned limited company, and other forms (additional useful thinking from AssetsInCommon.org).

- Systemic investment logic focused on an interconnected range of initiatives which include public, private and civic impact strategies.

Additional aspects which might be extremely useful include the likes of:

- Impact platforms, such as Toha's Mahi platform (example: East Coast Exchange)

- Financial infrastructures such as participatory granting and budgeting tools (example: Cobudget) and open collective finance platforms (example: Open Collective)

Wrap Up

If you made it this far, I don't know what to say...? Thanks for staying with the trouble!

Please do feel free to leave a comment or reach out online and share anything this has sparked, questions you may have, or any other musings!

Here's two bonus resources to say thank you:

Case Study: TransCap's Net Zero Mobility systemic investing update (PDF).

Case Study: TransCap's Builder's Visions Ocean Strategy systemic investing report (PDF).